Hope for Progress?

Few were surprised when voters statewide rejected Amendment Seven that would have increased sales taxes three-fourths of 1 percent to fund a variety of transportation infrastructure improvements. So another year goes by, and nothing gets done. And another. And still another. And how many more after that? Voters balked the poorly devised amendment for a number of reasons but mostly because truckers got a pass on motor fuel taxes, while we “four-wheelers” are angry and intimidated by the big rigs as they tear up Interstate 70, most of which is at least half a century old.

Few were surprised when voters statewide rejected Amendment Seven that would have increased sales taxes three-fourths of 1 percent to fund a variety of transportation infrastructure improvements. So another year goes by, and nothing gets done. And another. And still another. And how many more after that? Voters balked the poorly devised amendment for a number of reasons but mostly because truckers got a pass on motor fuel taxes, while we “four-wheelers” are angry and intimidated by the big rigs as they tear up Interstate 70, most of which is at least half a century old.

Maybe only the direst of emergencies will arrest voter intransigence and come up with a way to generate the cash to fix the state’s crumbling infrastructure. One almost wishes the governor could declare a state of emergency and get folks back on the job and plunge into the growing list of projects that need attending to. Tolling would represent the easiest and quickest fix if it were legislatively possible, but it is not. It wouldn’t take very long to put toll booths with the E-ZPass option at the Warrenton and Higginsville exits, charge $1 per visit and watch the cash roll in.

Missourians justly celebrate fiscal responsibility, balanced budgets and superior bond ratings while wisely eschewing deficit spending. MoDOT deserves encomiums of praise for doing so much with so little, but the sands in the revenue hourglass have been thinning for years. Any hope for progress in Missouri has been crippled by the nightmarish consequences of two of the worst restrictions ever put into force: legislative term limits and the Hancock Amendments. Sure, to raise the hackles of my conservative friends, progress in Missouri has been severely stymied in recent years by the unintended consequences of these two rather odious and apparently permanent restrictions. Then there’s the stubborn refusal to increase motor fuel taxes over the years and the slavish legislative devotion to lobbyists as opposed to the voters who presumably elect these solons.

Taxes, taxes, taxes

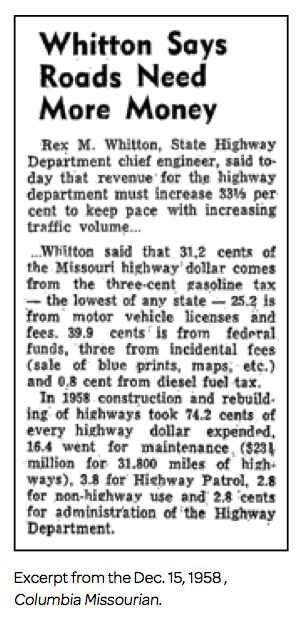

General sales taxes in Missouri were first enacted as temporary measures to fund relief and welfare disbursements during the Great Depression. The first temporary sales tax became permanent, the rate went from 1 to 2 percent and then 3 percent on Oct. 13, 1963; it is now 4.225 percent. Cities and counties could not levy additional sales taxes at first, but this restriction was eventually lifted, and Columbia joined the sales tax bandwagon in 1970. Given its thirst for revenue, it’s somewhat surprising that Columbia — with thousands who work here but live elsewhere — has not considered a city income tax along the lines of the “earnings tax” voters in Kansas City, Missouri, passed on Nov. 5, 1963.

We can thank the marvelous Hancock Amendments for this colorful, albeit bitter sundae of layered sales taxes as city and counties have scrambled in recent years to cunningly devise new ways to extract money from us. Few can list and give the fractional percentages of additional sales taxes tacked onto the basic 4.225 percent rate. Depending on where you shop, the layer cake of sales taxes approaches 10 percent. The latest admittedly ingenious way of extracting new revenue — still only a proposal here — would generate new fees based on travel and trips taken.

Because it’s rather easy to implement, business establishments would be metered via driveway-imbedded sensors with fees remitted to the city based on the number of visits. If 10,000 cars went through a given establishment’s drive-thru facility every month, and the fee per visit was $1, that would add up to $120,000 a year. Multiply this by hundreds of situations across the city, and the bountiful revenue surge would be substantial. If the drive-thru dispenses food, add $1 to the price of the comestibles, and chalk it up as a cost of doing business in our fair city.

Big Brother is watching

Even craftier is the idea to monitor trips taken from your home to wherever. The city owns the streets, which are lined with thousands of utility poles. The rush to saturate Columbia with privately owned fiber optic networks plus the city’s own fiber network opens the door to exhaustive video monitoring of our homes and the movement of its respective occupants both to and from. Technology outdoes itself every day as pole-mounted state-of-the-art cameras and other sensing devices can identify license plates, recognize and profile faces and otherwise monitor our activities, relaying these seemingly innocent gleanings over infinite-capacity fiber networks to whoever deems it their business to know about us.

As Big Brother is invited to monitor our daily activities, a trip taken from our home to wherever would be effortlessly monitored and logged by the agency charged with following our movements. A taximeter of sorts follows your wanderings from home to wherever and charges you so much per mile of each trip taken. Assume the starting rate for excursions from home is a 1 cent per mile, and the accumulated mileage per month is 300. That means you would kindly render $3 to the Caesars of the City, tacked on to your Columbia Water and Light bill. It’s Orwellian to be sure but entirely possible in this new era of high tech where increasingly pervasive government monitoring has invaded our private lives.