What’s in a Name?

After 144 Years, how did Boone County National Bank transition to Central Bank of Boone County in only 45 days?

Each year, more than 2.3 million couples exchange vows across the country. Plans are made, dresses are purchased, and guests are invited. Yet the work doesn’t stop after the couple says “I do.” Once the honeymoon is over, most brides must still go through the tedious process of changing their name.

Their name. A series of letters strung together to form an identity. A moniker they’ve written and signed for decades. A word that distinguishes their personhood on everything from their driver’s license to their email address. Yet no fanfare is needed, no public relations campaign or marketing specialist. A bride announces she’s a newlywed, and her community understands.

But what happens when a community institution like Boone County National Bank decides to change its name, after more than a century? It takes a good reason, some killer data, a few crazy ideas, great prizes and a host of creative people, working together, to make it fun.

Respecting History

The woman behind the rebrand is Mary Wilkerson, senior vice president of marketing and a 23-year veteran of the bank. “The biggest challenge was to communicate that we weren’t changing who we are,” Wilkerson says. “We had a lot of brand equity in our name.”

Central Bank of Boone County, named Boone County National Bank for more than 144 years, is steeped in the history and tradition of the early Midwest, as Wilkerson explains while peering through her purple-rimmed glasses and sipping on her first of several cups of coffee for the day.

The bank draws its roots from Moss Prewitt and R.B. Price Sr., who established the firm of Prewitt and Price in 1857, which became the Columbia branch of Exchange Bank. Six years later, the National Bank System was created, and National Charter No. 67 was granted to the bank under the name “First National Bank of Columbia.” It was the first national bank organized in Missouri.

But during the tumultuous times of the Civil War, the bank gave up its original charter and did business under a state charter. Then, on Jan. 1, 1871, after the war had concluded, the bank resumed its national charter under the name “Boone County National Bank,” the name etched in the top of their building on east Broadway, and the name the bank held until last June.

In 1974, Boone County National Bank joined Central Bancompany, a Jefferson City-based holding company, which gave it room to grow while still offering community-based banking. This transition made them one of 13 independent banks, with more than 130 combined locations, in a four-state region.

“Columbia is perfect for our model,” says Dan Westhues, senior vice president of Central Bancompany. “Community banks can really flourish and make an impact in markets like Columbia.”

Adapting to New Realities

In recent years, with the public’s increased use of the Internet, along with the financial challenges that began in 2008, Westhues and the holding company realized that, to stay true to their business model, they needed to clarify the benefits of being part of a larger system, and move the four banks affected, including Boone County’s, to state charters.

Wilkerson says much of the decision was rooted in practicality: “Our customers didn’t know about simple things, like which ATMs they could use. We needed them to be able to identify all the banks in our company.”

Serious discussions began in 2010, and in 2013, the decision was made to bring all 13 independent banks together under the same name. In late 2014, banks in Kansas City, St. Louis and Mexico went first, amending their names to “Central Bank.” In June of 2015, the remaining banks, including Boone County National Bank, followed suit.

In the six months since the change, Westhues says that customers’ use of branches outside of Columbia has exploded. “The number of transactions where customers are using a non-Columbia branch is in the upper 1,000s and growing around 20 percent each month,” Westhues says. “They have figured out our network is bigger, and they are using it.”

Before the change, the holding company found it challenging to market 13 independent banks in a digital world. “We couldn’t compete locally online,” Westhues says. “It was too noisy, and the individual banks ended up competing with one another.”

By aligning the banks’ names, Westhues says they have started gaining traction toward a stronger presence online, particularly in the world of search engine marketing and optimization. “Our digital marketing dollars are more valuable as well. Now we have the best of both worlds,” he shares. “Working under one name gives the banks the lift they need in the Internet market while maintaining their local identity.”

Wilkerson also notes that, with the passing of the Dodd-Frank Wall Street Reform and Consumer Protection Act, following the financial crisis of 2008, the regulations for national banks became onerous. While most of the regulations were designed for larger banks, Boone County was still affected. “When I started,” Wilkerson recalls, “there was one part-time compliance officer. Last year, we had five full-time officers to keep up.”

Switching to a state charter also made it necessary to drop the word “national” from the name, so a name change simply made sense.

The transition would have to be seamless. The bank couldn’t legally use the new name until after June 12. “We couldn’t be two banks at once,” Wilkerson says, “so that necessitated changing everything simultaneously.”

Clarifying Change

Just how many projects did “everything” equate to? Wilkerson and her team identified 175 different tasks involved in changing their name. “To say I was distressed is an understatement,” Wilkerson says. “It was an organizational nightmare. Once the Federal Reserve approved the change, we had 45 days to implement.”

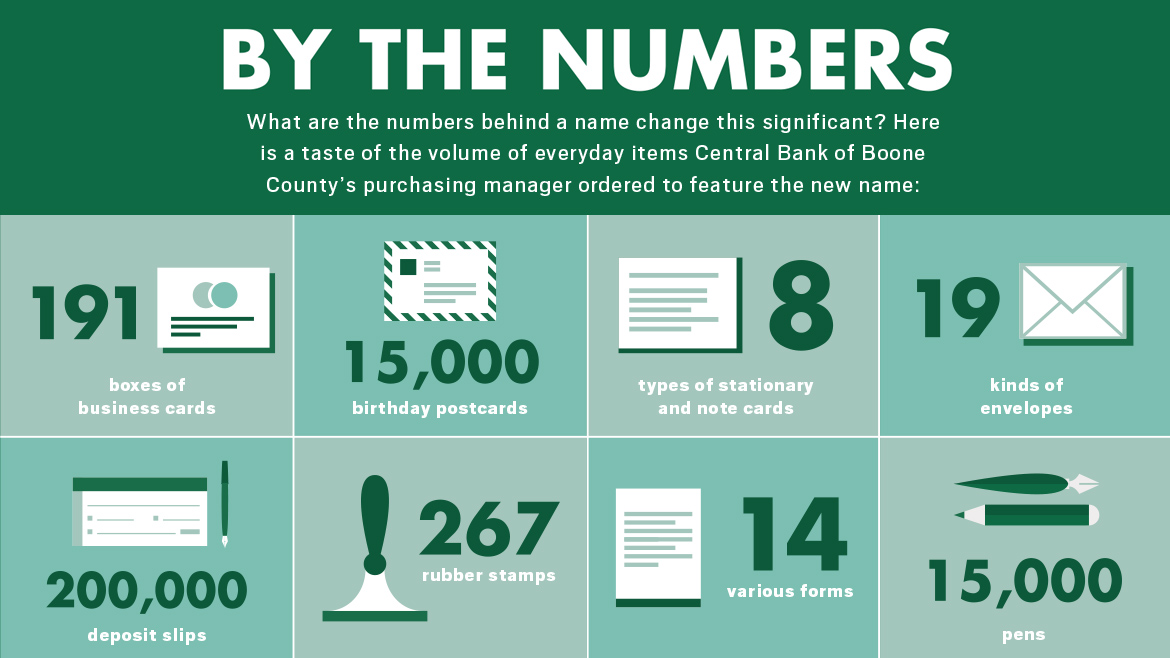

But even before the final decision was made, Wilkerson got a team of people together and hit the ground running. The group was responsible for updating everything from PDFs and forms to business cards, deposit bags, parking meters and even the brass plaques adhered to the marble on the outside of the building.

“The head of purchasing had her hands full,” Wilkerson adds with a smile. A sign company from Springfield came to town and changed the signage at all branches in just three days.

Westhues jokes that, once the project was underway, he didn’t sleep for six months. “Columbia was our number one priority,” he says. “They were one of our strongest brands, with a very strong connection to their community, and we didn’t want to disrupt that.”

In making the change, Wilkerson focused on two audiences: the bank’s employees, and their 40,000 customers. The change didn’t disrupt business, on a foundational level, for either group, Wilkerson says. “That was such a blessing.”

Customers were still able to use the same debit cards, checks and credit cards. “I just had to deal with hearts and minds,” Wilkerson explains, “and help people realize that the change was exciting, positive and fun.”

To prepare customers for the change, and to add the personal touch that is representative of their brand, 50 bank employees made personal phone calls to a combined 4,000 customers, a process that took six months.

To lighten up the experience for bank employees, each was given a “swear jar” to use for six weeks after the new name became official. They paid the jar each time they called the bank by the old name, and the $150 collected was given to Centro Latino, a local charity designed to empower the Latino community.

Wilkerson also knew that a successful name change meant more than just completing a set of necessary tasks, informing the appropriate people, and making it fun. She needed the project to come alive, to create an experience the community would never forget. For that, she called in some old friends.

Creating Synergy

To round out the marketing efforts, the holding company and the bank engaged the services of Columbia firms Woodruff Sweitzer and True Media. “Both companies are long-term partners, and they were critical to our success,” Wilkerson says.

True Media’s role was to analyze how to get the message and campaigns to customers in the most efficient and effective ways.

“We look at lots of consumer behavior data to determine how consumers get information – radio, TV, print, Internet, social media, etc.,” says Jack Miller, president of True Media. “Our customized media strategy ensures that Central Bank’s customers are exposed to the message based upon how they, as consumers, interact with the media.”

“Since Boone County has been a long-standing institution in the community, we needed to communicate that nothing was changing except for the name,” says Kim Odom, the bank’s account planner at True Media. “Since habits are hard to change, this required developing a media plan that reached 90 percent of the market with the message over an extended period of time.”

Woodruff Sweitzer, a creative partner with the bank for more than 20 years, was tasked with developing the brand and creative strategy for the holding company’s overall advertising campaign, as well as with brainstorming ways the Boone County community could celebrate the new name.

The lynchpin of the creative strategy was a series of technologically innovative commercials, featuring a watercolor painting effect that highlighted the bank’s roots in local communities. The idea was to simply, yet elegantly, inform customers that they could expect all the convenience of a big bank with the personal service of their hometown bank, and also that they could access their accounts anywhere they saw the white dogwood logo.

To localize the message, Shannan Baker, a Woodruff Sweitzer account manager, devised two innovative ways to help the public see how Central Bank of Boone County could help them accomplish their dreams. For five nights in early June, the bank projected animated scenes on the east side of their downtown building. The broadcasts used 3D mapping and included scenes of engaged customers that tied into the overall media campaign.

The team also created 14 “dream orbs,” ranging from 24 to 60 inches in diameter, that rotated around to different branches. The displays inside resembled Macy’s department store windows and represented prizes the bank was giving away.

The public could register to win the prizes at any of the branches, and the names were drawn at the Summerfest show that the bank sponsored on June 4. Prizes included a scooter and a boat. “They made 14 people really happy,” Baker says.

Measuring Impact

What about the results? “We were really happy with the way things worked out,” Baker says. “It’s fun to work with a client who is willing to be bold and brave and do things for the community.”

Those at True Media agree. “It was fun to be part of the change and to work so cohesively with the marketing team at the bank,” says Miller. “We were just happy to help make their jobs a little easier.”

As for Wilkerson, time will tell. “We need 18 to 24 months to evaluate the impact,” she shares. “We understand a change like this is a long-term process.” In the end, Wilkerson believes the bottom line is that the bank is delivering for their customers. “If we do see negatives, we will fix them. That’s what makes our customers want to do business with us.”

What’s next for the bank? Westhues says he has one task left to complete. “We’re launching a new single brand web experience in late February. With this final piece, we will really start to see the online benefits of the name change.”

Wilkerson has one element of the project to wrap up as well. With a deep sigh, she points to an overflowing expandable file on her credenza, a pile that represents the love and sweat she has put into this project. “I have one sign left to finish, and then I can file the paperwork away.”

Despite the countless work hours and lack of sleep, Wilkerson is proud of the work her team accomplished. “It’s been a remarkable year,” she says. “The bank has an unwavering commitment to our community, and that’s meaningful to me.”