Click to Play: The business behind online credit card payments

In today’s world of Internet transactions, credit is king. But what’s the best way for a new or existing company to go about accepting payments? Consider these popular methods for online credit card payments:

In today’s world of Internet transactions, credit is king. But what’s the best way for a new or existing company to go about accepting payments? Consider these popular methods for online credit card payments:

1. Obtain a merchant account, often from a banking institution, and subscribe to a payment gateway service. Some banks offer a payment gateway service; many third-party providers are also available.

What this means: Many brick-and-mortar shops already accept credit card payments by pairing a credit card-processing machine with a merchant account from their bank. The bank acts as the “acquirer,” confirming funds are available, authorizing transitions and exchanging funds from the bank issuing the credit card. After the payment is given the green light, the funds are transferred into the attached company bank account.

When taking payments online, a payment gateway acts as the credit card machine and securely transfers the information to an Internet merchant account that allows you to accept cards without physically scanning them.

Charges: Merchant accounts and payment gateways may have a variety of fees such as setup fees, monthly service fees, per-item fees or total percentage of the amount charged.

Pros and cons: This option is great for businesses accepting large volumes or amounts of online payments because the transaction fees are generally less than the alternative all-in-one payment-processing company. It’s also a favored choice for businesses that already have a merchant account to accept in-store payments.

For those who don’t have an existing merchant account, applying for the service often involves paperwork and documentation of company financials. Setting up a payment gateway is not an instantaneous process either, so the setup time for this method takes longer.

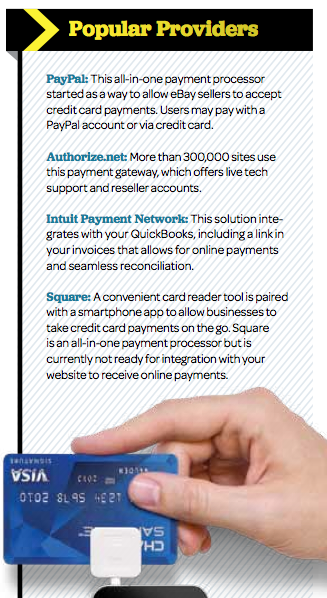

2. Enroll with an all-in-one payment-processing company.

What this means: These services, including the very popular PayPal, combine your merchant account and payment gateway all under one roof. These companies process transactions through their own merchant account on behalf of other companies.

Charges: Most all-in-one payment-processing companies don’t charge monthly or setup fees for basic accounts. However, upgraded features are often available for a monthly fee. Payment for services is charged based on transactions, often a per-item and total percentage fee on the amount charged.

Pros and cons: This service is a good option for businesses that will be accepting a small amount of online payments. Although the transaction fees are higher, if volumes are low, businesses can save money on required monthly fees and setup fees. It’s also a good option for those that need to take payments quickly without delay. However, most all-in-one payment-processing companies require payments to be made on their website, which directs visitors away from a business’s website