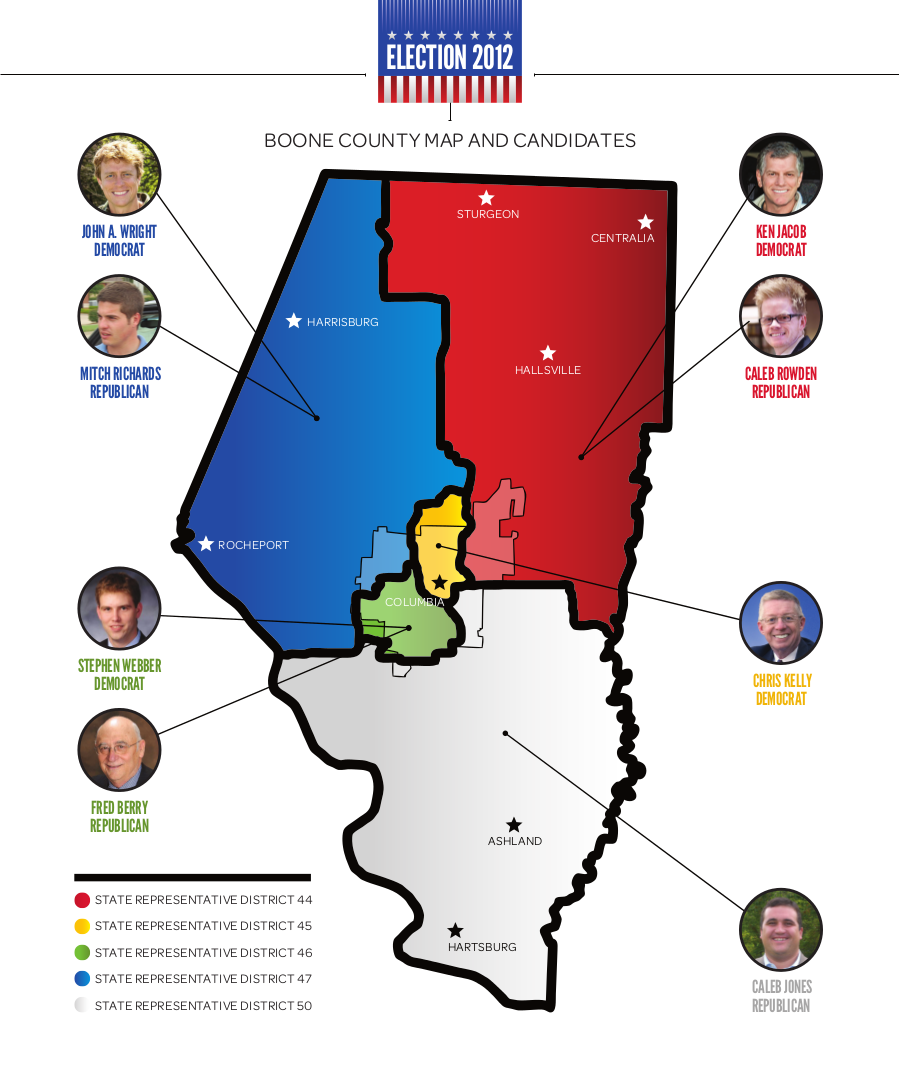

Growth & Competition

What Each Legislative Candidate plans to do to help Businesses in Boone County

Party:

Republican

The problem:

Missouri is competing with other states and countries to attract new businesses and jobs, and Missouri needs a way to set itself apart.

The solution:

A statewide, state-funded workforce-training program would be offered to businesses in exchange for new jobs.

THE DETAILS:

Although some Missouri schools already work with businesses to develop training programs, Caleb Rowden said a coordinated statewide effort with funding is needed. The Department of Economic Development would work with existing schools and programs.

“I think this is partnering with those entities and just taking it further,” Rowden said about working with schools such as Moberly Area Community College. “A lot of projects that are being introduced right now are contingent upon the schools going out and raising their own money, so I think this is a matter of the state putting its money where its mouth is.”

Rowden said he envisions the program would be free for businesses and the students or trainees. He estimates it would cost less than $25 million to create and implement the program. The funding could come from eliminating or decreasing some tax credit programs, which he said cost Missouri $650 million in 2012.

“I’m not sure I could or would specifically say which of these credits need to be phased out to provide resources for this project until I was in the legislature and really able to gain a solid understanding of the credit programs in their entirety,” Rowden said.

The program would work like an incentive program. Businesses would commit to generating a certain number of jobs in exchange for receiving training programs, and there would be an application process to participate.

COLUMBIA REACTS:

Local business Riverview Technology offers myriad computer-related services including computer repair, network configuration, installation of surveillance systems and communications wiring. Owner and CEO Ray Buchli said he hasn’t had any problems finding employees who already have training and experience.

“A lot of people thought when IBM came into town, they would take everyone, but they didn’t,” Buchli said.

The economic downturn is part of the reason behind an available workforce. Buchli said his staff has decreased from seven to three employees in the past three years. With the decreased business, he said finding employees just hasn’t been a problem.

Luis Jimenez, CEO of EteroGen, has had a different experience. Located in MU’s Life Science Business Incubator, EternoGen projects hiring 25 people within two years and 50 people by the end of their third year. The company develops medical applications for a collagen-based material. Jimenez said the pharmaceutical work they do is very technical and a local training program could be helpful.

“Those kinds of training programs could help us find local employees.”

Party:

Democratic

The problem:

Missouri struggled to make ends meet after a $500 million budget shortfall for 2012.

The solution:

Opt for an expansion in Medicaid that could add approximately $1.5 billion per year to the state budget for four years and assist growth in the health care industry.

THE DETAILS:

President Barack Obama signed the Patient Protection and Affordable Care Act in March 2010. One provision of the act expands Medicaid coverage to people who have incomes at or below 133 percent of the federal poverty level: about $15,000 or less annually for a single person or $20,000 for a two-person household.

Originally, this expansion was required for states, but the Supreme Court ruled the expansion as optional for states. If Missouri moves forward with the expansion, the federal government will cover 100 percent of the cost for the first three years, 2014 to 2016. In 2017 Missouri would have to start contributing, but the act caps states’ responsibility at 10 percent of the cost.

Ken Jacob says it might be difficult to find the money in 2017, but it’s worth the risk. “If there is $1.5 billion spent on health care in Missouri, then that’s going to be a lot of health care and a lot of health care jobs in Missouri,” he says. “And that looks pretty good to me.”

Jacob says it would also increase state revenue to support the University of Missouri, which is his biggest priority.

COLUMBIA REACTS:

The Missouri Hospital Association is working with the Missouri Foundation for Health and MU researchers to analyze the potential financial and economic impact on hospitals and communities. Mary Becker, from the hospital association, says they expect to have a better analysis done in about a month.

Although they are waiting on the further analysis, Becker points out that if Missouri expands Medicaid, they estimate that the state could receive $8.4 billion in federal money between 2014 and 2019 and only have to contribute $430 million in state money. The federal money would be new money coming to the state economy. That money could mean more health-related jobs and more business for companies that supply hospitals.

With the Medicaid expansion, hospitals could expect fewer uninsured patients. This would mean spending less of their budget covering the cost of treating uninsured people. As part of the Affordable Care Act, payments to hospitals for treatment of the uninsured are expected to decrease as a result of fewer uninsured patients, Ryan Barker from the Missouri Foundation for Health says.

If Missouri does not expand Medicaid and take the federal money that goes with that, then they will be in a position of still having to pay for the uninsured but getting less federal support to do that.

“Everybody that’s supplying products to the hospitals, that’s a boost to those industries,” Barker says.

Party:

Republican

The problem:

A tax system based on income and corporate taxes is too narrow and volatile in times of economic depression.

The solution:

Eliminate corporate and personal income taxes, and replace them with a consumption tax.

THE DETAILS:

Most Americans already pay some consumption taxes in the form of sales taxes, but Fred Berry is proposing something quite different. His goal would be to tax nearly all consumption and no earnings. According to the Missouri Department of Revenue website, Missourians currently pay a 4.225 percent sales tax, but some things aren’t taxed or have a lower rate, including certain food items. Berry would add a tax on to most services but says certain necessities, such as food and education, wouldn’t be taxed.

Without a corporate tax, none of the tax credit incentive programs would be possible, but Berry says they wouldn’t be needed either. He says eliminating Missouri’s tax credit programs would return $400 million to Missouri’s general revenue.

“Government does not tend to be good at business development,” Berry says. “We’ve got an attractive workforce here, so why give away tax credits when you don’t need to?”

Many people avoid income taxes through loopholes and other means, but avoiding a sales tax is harder, Berry says. Although spending decreases during economic downturns, spending doesn’t fluctuate as much as incomes do.

Berry says the details would need to be decided by a legislative committee. His preliminary research in 2010 indicated a consumption tax between 5 and 7 percent would produce a similar quantity of revenue for the state.

In a Brookings Institute article on consumption tax, William Gale points out that consumption taxes are harder on lower and middle-income citizens. Lower-income individuals spend a higher percentage of their income, whereas higher-income citizens have the ability to save more of their income and consequently pay fewer taxes per dollar earned.

In 2011, individual income taxes generated 67 percent of Missouri’s general revenue, corporate taxes generated 5 percent, and the sales and use taxes generated 27 percent.

COLUMBIA REACTS:

Columbia Chamber of Commerce President Don Laird says moving toward a consumptive tax is worth evaluating. Without knowing more details and without more analysis, he couldn’t say what sort of impact this change could have or how it would be received in the business community.

“I really don’t know the ramifications to the business community, and I think the business community would be split,” Laird says.

Eliminating income taxes and replacing them with a consumptive tax was not something the Chamber had discussed or evaluated.

Party:

Democratic

The problem:

Missouri entrepreneurs sometimes struggle to raise money to start new businesses.

The solution:

Use a percentage of new tax revenue generated by science and innovation businesses each year as seed money to help science and innovative startup companies.

THE DETAILS:

Since Rep. Tim Flook introduced the Missouri Science and Innovation Reinvestment Act in 2010, the bill has been reintroduced every session, and a few members strongly opposing any new spending programs defeated the bill each time.

During the 2011 special session, legislators passed a version of the Reinvestment Act with a provision that it would not be enacted unless another economic development bill, Senate Bill 08, passed. A right-to-life group opposed the Reinvestment Act because it had no protections against abortions, cloning or stem cell research and challenged its constitutionality when Senate Bill 08 failed to pass. The courts found the Reinvestment Act bill to be unconstitutional because of its link to the unpassed Senate Bill 08.

Stephen Webber wants to pick up the bill again because he believes Missouri misses economic opportunities when these ideas go unfunded.

“A lot of these people have good ideas but can’t get over the hump and raise money,” Webber says. “But the state could be an investor.”

As introduced in 2010, the bill set up an account funded by increases in tax revenue from growth in the science and technology industries, but Webber also suggests using a portion of the revenue from an online sales tax to fund the endeavor.

COLUMBIA REACTS:

The Missouri Biotechnology Association, a nonprofit trade association dedicated to development and growth of the Missouri biotechnology and biomedical industry, reaffirmed its support for the bill after the Missouri court ruled the latest version unconstitutional.

“We [Missouri] are highly successful in bringing in grant dollars for research,” says Kelly Gillespie, executive director of the association. “Where we fall short is that we do that research, and then we leave that research on the shelf.”

Gillespie says a similar program in Iowa has funded $1.3 billion in development and has been reapproved by voters two times. An outside auditor found that every dollar spent in the Iowa program has generated $9 in the economy.

According to Gillespie, a fund like this is needed in Missouri because of the challenges associated with bringing new technologies to market. The complexity of applying for patents, the research and development needed to create a consumer ready product and the federal approval process mean companies may take years to get off the ground. But with startup investment, these types of companies bring in well-paying jobs with salaries of $60,000 to 80,000 for most employees.

Party:

Republican

The problem:

The corporate income tax weighs Missouri businesses down compared to states such as Kansas that have eliminated the tax.

The solution:

Follow Kansas Gov. Sam Brownback’s lead, and drastically cut or eliminate corporate income taxes.

THE DETAILS:

The Kansas legislature passed a significant tax cut bill this spring. It reduces the highest-bracket personal income taxes from 6.45 percent to 4.9 percent. Corporate taxes were reduced because nonwage income will no longer be taxed. Brownback had planned to increase sales taxes to account for the revenue lost through other cuts, but the bill emerged without any tax increases.

Mitch Richards also hopes to offset corporate tax cuts with increased sales taxes so the change will be revenue neutral for the state. Richards says cutting corporate taxes frees up money within businesses that may then be reinvested in equipment, new employees or expanding facilities. He also says the cost of the corporate tax is already passed on to consumers in higher prices. With the tax cut, product prices should fall, and the increase in sales taxes will result in no cost increase to the consumer.

“The tax won’t increase costs to low-income consumers because the amount those folks are paying right now already includes the cost of the taxes,” Richards says.

COLUMBIA REACTS:

Larry Potterfield, founder and CEO of MidwayUSA, says eliminating corporate taxes would greatly benefit small businesses in Missouri.

“In many cases, small-business owners continuously put profits back into their company to grow their business,” Potterfield says. “If there was no corporate tax, small businesses in Missouri would have more money to invest in their own companies, so they could grow faster and create more jobs.”

For example, Potterfield says, if a company made $500,000, it would owe a little more than $31,000 in corporate income taxes. “Thirty-one thousand dollars would basically allow a company to hire one more employee,” he says.

Although Potterfield says eliminating corporate taxes for a few years would assist economic recovery, he isn’t certain it should continue indefinitely. He adds that it might be best not to extend the tax cuts to all businesses. By limiting them to small businesses with fewer than 500 employees, Potterfield says he can envision positive results.

“People respond very well to tax-free things,” he says. “Look at the back-to-school sales tax holiday — people go crazy.” He believes something similar would happen among small-business owners in lieu of a corporate tax and lead to greater investment and more jobs across the state.

Party:

Democratic

The problem:

Under current law, when a Missouri resident makes an online purchase from a business that has no physical presence in the state, neither the business nor the consumer pays a state sales tax.

The solution:

Give local businesses level footing with their online competitors by taxing Internet sales from out-of-state businesses to Missouri residents.

THE DETAILS:

As CBT reported in May this year, an MU study estimates that Missouri missed out on $468 million annually during the past decade. The research estimates that the Internet sales tax in Missouri could have brought in $1.4 billion from 2011 to 2014.

“We shouldn’t have a tax code that favors out-of-state businesses at the expense of local merchants,” John Wright says. “The simplest analogy is if we tilted Faurot Field so we had to run uphill, and the out-of-town opponents got to run downhill.”

After a Supreme Court ruling stated that the existing state sales tax policies were too complicated and out-of-state businesses could not be required to pay them, the Streamlined Sales Tax Group developed an agreement to make it easier for businesses to pay taxes.

Although out-of-state business participation in the streamlined agreement is voluntary, Wright would like to see Missouri join 24 other states in adopting the Streamlined Sales Tax agreement. Wright says he would also lobby our federal legislators to pass a bill that would allow states to require out-of-state businesses to pay sales taxes on online sales.

Missouri Sen. Roy Blunt (R) co-sponsored The Marketplace Fairness Act, which legislators introduced late last year. The bill clarifies states’ rights to tax out-of-state businesses for sales made in state and defines the practices states are required to use to collect taxes from out-of-state businesses. If Missouri adopted and enacted the agreement, the state would have the policies in place needed to meet the requirements of the fairness act. The Marketplace Fairness Act was referred to the Committee on Finance in November 2011, where it remains for the time being.

COLUMBIA REACTS:

Doug Wilson, co-owner of Columbia’s Village Books, says he thinks collecting an Internet sales tax would help his business and the community.

“It will be huge,” Wilson says. “It will be absolutely huge. We get calls all day long, and people are price shopping. I completely support that. They’re looking online, and Amazon doesn’t have to pay taxes.”

Liza Babington, assistant manager at Columbia’s Alpine Shop, says she isn’t sure how much a change in the tax code would affect her shop.

“I don’t know if we’ll see a huge boom in business because of an online sales tax,” Babington says. “There’s probably a fair number of people who won’t notice because they don’t even know they aren’t paying it.”

Party:

Democratic

The problem:

Most local legislators agree MU is the most important economic engine for our region, but because Missouri’s general revenue decreased by $2 billion from 2008 to 2009 and revenue only grew 3.2 percent from 2011 to 2012, the state’s funds have struggled to keep up with the university’s needs.

The solution:

Invest in new infrastructure at state universities and community colleges by passing the Fifth State Building Fund.

THE DETAILS:

Although many legislators had trouble picking one priority to highlight, incumbent Chris Kelly had no trouble narrowing it down.

“By a long shot, the most important thing the legislators could do for Boone County is pass a bond issue for higher education construction,” Kelly says.

Since 2008, Kelly has been pushing for a bond to build new infrastructure for higher education. In 2009, Kelly introduced a $500 million bond to fund a new engineering building and a new health sciences building on the Columbia campus, but the bill wasn’t just focused on Columbia. State community colleges such as Moberly Area Community College were also included.

For example, Kelly says the MU health sciences program turns away qualified students every year because the facilities are too small. Meanwhile, Missouri is in constant need of more health care professionals.

“There are already jobs for them; they will fill every job available,” Kelly says about health sciences graduates. To meet the demand of the health care industry, Kelly says Missouri brings in 1,200 nurses from out of the country every year.

The bill didn’t make it out of the Senate, but Kelly says it was a result of a small group of legislators who are no longer there. “I think our chances are much better this year than in the past because some of the most unreasonable opponents have left the legislature,” Kelly says.

COLUMBIA REACTS:

At Columbia’s Boone Hospital Center, hiring qualified staff to meet its standards can be challenging and will likely only become more so. Boone Hospital Human Resources Director Michael Zvanut says they recognize the need to ensure educational infrastructure to keep up with future hiring needs.

“While we have an excellent, highly trained staff, it is often a challenge to fully meet our hiring needs,” Zvanut says. “With the influx of baby boomer patients coming over the next several years, and with health professionals of that generation beginning to retire, we expect the demand for new health care workers to continue to rise.”

Party:

Republican

The problem:

Current and prospective Missouri businesses sometimes have difficulty finding qualified workers.

The solution:

Develop a program that teams educational institutions with employers to develop workforce education programs.

THE DETAILS:

Caleb Jones says business owners have told him they have difficulty finding qualified employees.

“One of the main concerns businesses have when moving to a place like Missouri when compared to other states is will they have the workforce there they need to run their business,” Jones says.

When IBM moved to Columbia last year, Jones says they had to bring in workers from outside the community. The number of out-of-state workers versus the number of in-state workers hired by IBM has remained a mystery.

In Boone County, 45 percent of residents have at least a bachelor’s degree, according to the U.S. Census Bureau. Across Missouri that percentage decreases to 25 percent, and the national average is 28 percent.

Jones says the program would be implemented through Missouri’s Department of Economic Development using existing infrastructure.

COLUMBIA REACTS:

Moberly Area Community College, also known as MACC, has an Economic Business Development Department that works with businesses to create training and certification programs for area businesses. Jeff Lashley, vice president of instruction at MACC, says the customized training program offered by MACC is running but has had some cuts.

“We’re always looking to partner with business and industry, and we do partner to develop training programs to meet their needs in training or certificate programs,” Lashley says.

Although MACC works with businesses directly already, Lashley says he thinks a statewide program focused on making sure businesses’ training needs are met could be a good idea.

Carson Coffman, president and chief operating officer of a local phone and Internet service provider, says his company hasn’t used many external training programs, but he likes the idea of having more options. Although his company, Socket Telecom, does need a skilled workforce, it usually hires people who have taught themselves skills or who already have experience working in the industry.