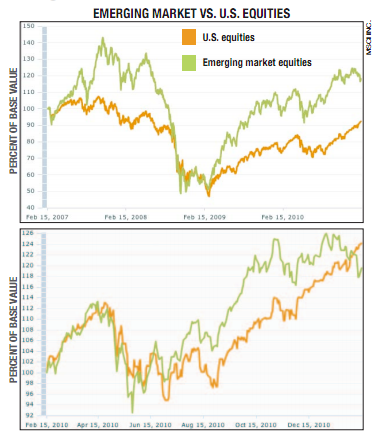

Emerging markets look less inviting

In the depths of the global recession, emerging markets in Asia, the Middle East and Eastern Europe snagged the dollars of investors attracted by their swift growth and worried that Western economies would be stuck in the doldrums for years to come.

But recently, many of those same investors became concerned that the high growth in developing countries could lead to inflation and, despite steps by those governments to keep prices in check, began pulling out.

People hoping to rebuild their battered portfolios poured money into emerging market funds during the past couple of years as experts sang the praises of countries such as Brazil, China and India, which escaped most of the pain wrought by the US housing collapse. Those inflows have mostly stopped during the past several months, drawn home by the rally in US equities and scared off by inflation and political unrest abroad.

Two weeks ago, emerging-market equity funds tracked by EPFR Global saw their largest outflows since January 2008. Last week, investors pulled another $3 billion out of emerging market funds followed by EPFR, on top of the $7 billion they yanked two weeks ago, according to Dow Jones.

US equity funds, by contrast, have taken in more than $20 billion during the past month and a half, according to EPFR.

The hesitation to keep putting money into emerging markets reflects both inflationary fears as well as uncertainty over what will happen when governments try to put the brakes on rising prices. Earlier this month, Indonesia raised its benchmark interest rate. China raised its rate a few days later, and Brazil is planning big budget cuts to stem inflation.

“There are pretty clear signs that inflation is heating up in the developing markets,” said John Pfenenger, CFA an investment advisor and president of Prism Capital Management LLC in Columbia.

Emerging market inflation fears have been simmering for a few months now. Pfenenger has been “paring back” on exposure to emerging market funds for about six to eight months, he said.

A Bank of America Merrill Lynch survey of fund managers on Jan. 18 found that 43 percent of asset allocators surveyed were overweight in emerging market equities, compared to 56 percent in November.

The recent outflows came as political turmoil in the Middle East heated up, most recently with the ouster of Egyptian President Hosni Mubarak. That unrest might have served as a trigger for investors already worried about inflation in other markets, Pfenenger said.

Scott Colbert, chief economist at the Commerce Trust Company, said he is still positive on emerging markets in the short term. But he is more cautious looking forward. It is unlikely emerging market funds can have another decade of more than 15 percent growth, he said.

“I don’t believe we can possibly repeat the performance we just had,” Colbert said.

That’s not to say the outlook for emerging markets doesn’t indicate strong economic growth. Pfenenger, however, cautioned that prices on securities tracking emerging markets already reflect the anticipated growth.

“If you look out over the next 10 to 20 years, the growth is going to be in emerging markets,” he said. “The question is: How much of that growth are you paying for up front?”

And for investors lured by rallying US equities, Pfenenger is skeptical of their climb as well. The Federal Reserve bond-buying program announced last year, known as QE2, is designed to keep bond prices low and has driven many investors to equities. That makes Pfenenger cautious on stocks in general.

“Really since (Fed Chairman Ben) Bernanke announced QE2, the market has been driven up to, in my opinion, questionable levels,” he said.