Wheres the money going?

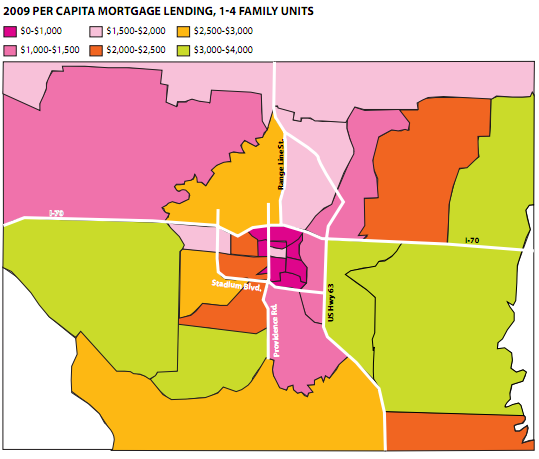

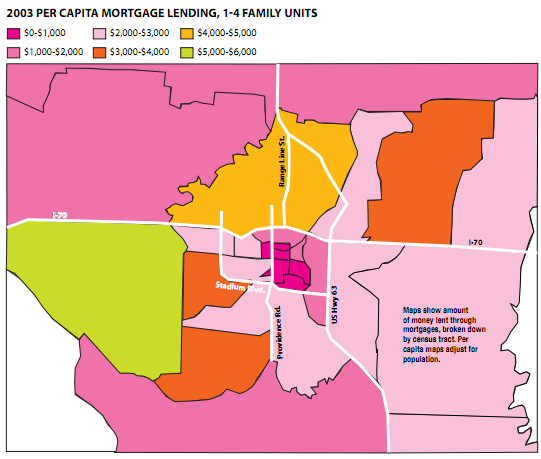

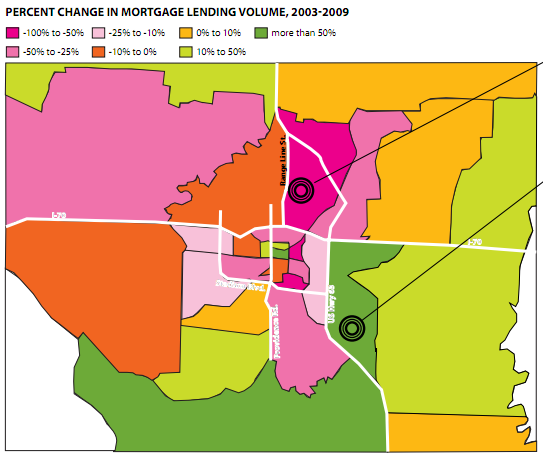

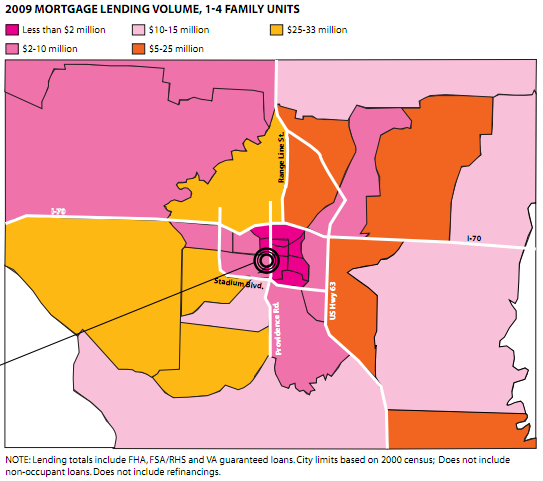

The CBT analyzed federal Home Mortgage Disclosure Acta data from 2009 and 2003 to show geographic lending patterns

Buyers opt for larger houses in south and east, take advantage of federal programs

Overall mortgage lending fell in Columbia in 2009 compared with the more stable years of the earlier part of the decade. But the total amount of mortgage lending in areas of southern and eastern Columbia actually increased because of new, more expensive homes there.

Mortgage lending in 2009 was relatively comparable to 2003, which was a more normal year in the real estate market than the booming middle years of the decade. Total Boone County mortgage lending in 2009 was $309.5 million, compared with $343.4 million in 2003. Lending peaked in 2005 at $458.2 million.

A hand from Uncle Sam

Homebuyers were able to take advantage of federal programs designed to make their purchases easier, such as loans insured by the Federal Housing Administration and loans guaranteed by the Department of Veterans Affairs. In 2003, those types of loans issued in Boone County totaled $40 million. In 2008, there were $69.5 million of federally backed loans issued in the area. They rose 64 percent to $114 million in 2009.

Boone County National Bank began offering FHA loans in 2008 and VA loans in 2009, according to Deborah Graves, the mortgage loan department manager. There wasn’t much of a need during the boom years of the decade, she said, because Fannie Mae and Freddie Mac were buying almost any mortgage.

“We were able to take care of a customer with a low down-payment by selling to Fannie and Freddie,” Graves said.

But beginning in late 2007, at the onset of the housing crisis, the government-sponsored enterprises decreased the maximum loan-to-value ratio on mortgages they would purchase to 95 percent, she said. So BCNB began offering the other products. The VA will guarantee loans with no money down. The FHA will insure loans with only a 3.5 percent down-payment.

Many buyers combined those programs with the federal first-time homebuyer tax credit, which expired last summer, Graves said.

“There was a lot of interest and discussion among people (in 2009),” she said.

Northern slowdown

The area that showed one of the largest declines in lending volume is the tract just north of I-70, bordered on the east by Route B and on the west by Range Line Street. Lending volume was 51 percent lower in 2009 than in 2003 and fell to $22.6 million from $45.8 million.

Much of that can be attributed to the huge boom the area was undergoing at the beginning of the decade, said Jack Blaylock, an appraiser with Cannon, Blaylock & Wise who has worked in Columbia for decades. Back then, vacant land in that area was about half the cost of land in the south part of town, he said.

Moving east

Eastern fringes of the city and on into the county saw the total amount of money lent to homebuyers increase even though the total number of mortgages there actually declined.

The area just east of US Highway 63 and bordered on the east by Rolling Hills Road and St. Charles Road, for instance, contained 104 mortgages in 2009, three lower than the total in 2003. But total lending in the area rose 63 percent, to $21 million, and reflected the availability of high-end homes in new developments such as the Vineyards and Old Hawthorne. The area of Boone County just past Columbia’s eastern border saw a similar pattern.

“A lot of product came online in those years,” said City Planning and Development Director Tim Teddy.

City planners and developers have been noting for years that east Columbia is the most poised for future development, and the data show that the area’s residential and development market has indeed performed more strongly than areas to the west and north of the central city.

Quiet neighborhoods

Areas containing medium- to high-value homes nearer the core of the city stayed relatively stable compared with 2003, though they showed slight declines in lending volumes.

“In the more stable neighborhoods, as the economy began to worsen and prices began to drop, there would have been very little activity except for refinancings,” Blaylock said. “Those people pretty much stayed at home and didn’t make a lot of changes.”

As with most cities, poorer neighborhoods in the inner city consistently lag behind outer areas in terms of the dollar volume of mortgage lending. Much of that can be attributed to the lower rate of homeownership in those areas, Teddy said. A little more than one-third of homes in the central city are owner-occupied, he said, though the city has observed that homeownership in the area has “ticked up a bit.”