Local SBA lending expands

At a time when capital was hard to come by, financing from the US Small Business Administration’s lending programs more than doubled in 2010 from the previous year in Boone County.

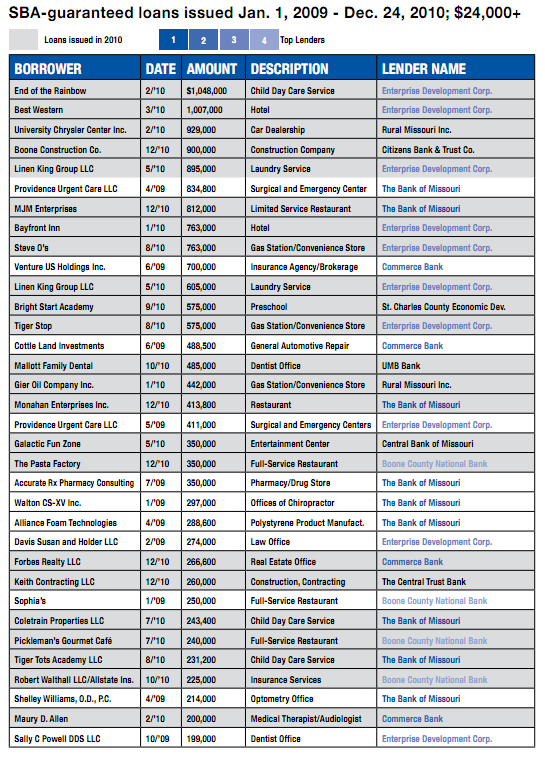

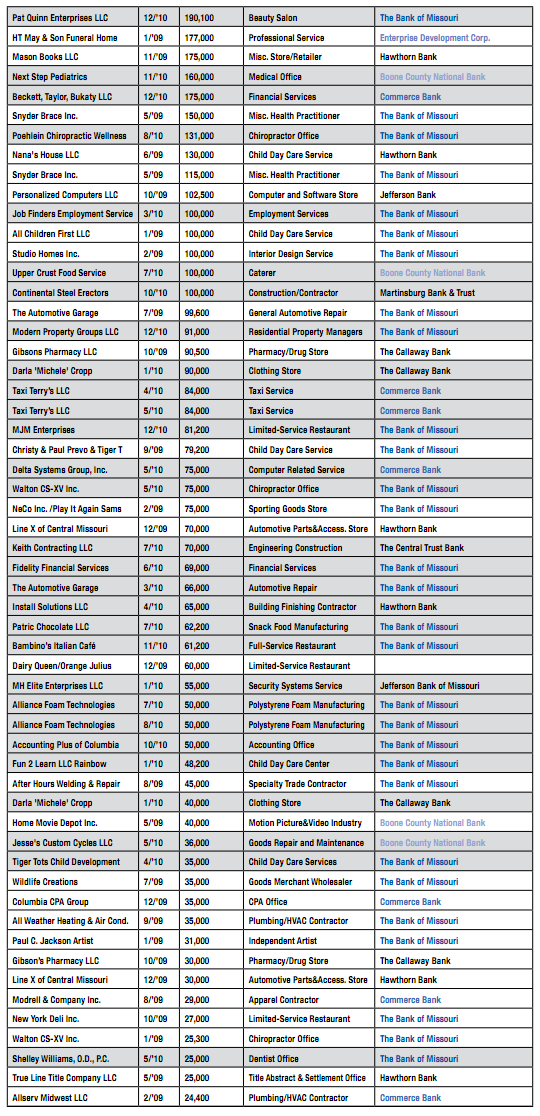

Local banks issued 56 SBA-backed loans last year that totaled $15.4 million, compared with 42 loans totaling $5.9 million in 2009, according to a list compiled by the CBT. The average loan amount also increased, from $139,300 to $274,000.

Issuing the most loans were The Bank of Missouri (40), Commerce Bank (14), Enterprise Development Fund (11), Boone County National Bank (8), Hawthorn Bank (6) and The Callaway Bank (4).

In 2008, 54 SBA-backed loans were issued totaling about $10 million. The largest that year went to Faber and Brand ($900,000), Gregory Stevens DDS LLC ($834,000), Campus Bar & Grill ($650,000), Doc and Norm Direct ($644,000) and Premier Paper and Packaging ($500,000).

The local pace is well ahead of the national increase. In the United States during fiscal year 2010, SBA lending increased 23 percent from the previous year to the highest volume in the program’s 50-year history.

In September, Congress passed legislation expanding the SBA program, an effort designed to stimulate small business and create jobs. And last month, the Missouri Development Finance Board approved changes to the state’s Small Business Loan Program. Businesses can now borrow $50,000, double the amount previously available. The loans, which are approved by the Department of Economic Development, can be used for capital and operational needs.