Downtown leadership merges, sales tax on horizon

The City Council’s vote establishing the downtown Community Improvement District was the culmination of three years of work and might lead to a half-cent sales tax next year that would fund efforts to expand commercial activity downtown.

The special taxing district, which will set policies and fund programs, brings together the Special Business District and the Central Columbia Association, which have sometimes lacked coordination, according to The District Executive Director Carrie Gartner.

The Community Improvement District also opens up new sources of revenue for downtown projects. The group will ask downtown residents to approve a half-percent sales tax, the same amount charged at stores and restaurants in the Columbia Mall and other major shopping centers in the city.

“It is important to note that a CID is a tool used successfully around the state,” Mike Vangel, an SBD board member and the chairman of its CID steering committee, said during testimony before the City Council on Feb. 7.

Kurt Mirtsching, a Central Columbia Association member, told the Council that merging the SBD and CCA into one group would foster communication between the two groups.

“Careful, thoughtful consideration, as well as my gut feeling, tell me this is the right thing for Columbia,” he said.

The city certified the petition to form the CID last month. The petition needed approval from half of the area’s property owners as well as approval from property owners owning more than half of the assessed value of The District.

The City Council unanimously supported the CID formation. Sixth Ward Councilwoman Barbara Hoppe noted that imposing a half-percent sales tax downtown would be no different from most shopping centers in the city, which impose a half-percent sales tax through Transportation Development Districts. Those districts are formed through the courts and don’t require a vote by the Council.

The CID won’t begin collecting revenue until October 2012, after the existing cycle of property tax collections currently designated for the SBD expires. Until then, the CID board will make policy decisions, but the SBD board will meet jointly to make financial authorizations until it is dissolved.

The next step is asking downtown residents to approve a sales tax. Documents detailing the CID’s plans submitted to the city assume $300,000 in sales tax revenue beginning in 2012. Gartner said that estimate was derived by averaging the sales tax collections in The District from fiscal year 2005 through fiscal year 2008 and then reducing the number by 15 percent to adjust for a weakened economy.

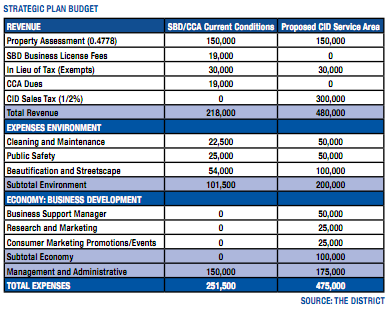

Should a half-cent sales tax be approved and its projections be on target, it would more than double the revenue the SBD and CCA take in now. The SBD is almost entirely funded by a 47-cent property tax per $100 of assessed valuation on downtown properties. The SBD currently takes in about $200,000 a year. That property assessment would remain unchanged, but SBD business license fees, which collect about $19,000 annually, would be eliminated.

The CID, according to its five-year plan, hopes to nearly double The District’s budget for cleaning, beautification and public safety to about $200,000 a year. The CID expects to spend about $100,000 a year on efforts to boost the downtown economy through market research, promotions, events and business recruitment and retention, including $50,000 for a business support manager.

The CCA, a tax-exempt organization, would retain that status and continue collecting membership dues after the CID begins collecting revenue, Gartner said.

The CID will likely divide members into three committees: an economic development committee, an operations committee and a marketing committee. The board is currently working to select officers, draft bylaws and form the committees, though the CCA might take the role of the marketing committee.

“The talk has been to make the CCA board essentially the marketing committee,” Gartner said.