Bank economist: Brighter days ahead for economy

Housing market, high unemployment still pose problems

The US economy is about back to where it was before the recession started, but growth and job creation will continue to be slower than previous recoveries. That was the underlying theme of a presentation by the chief economist of the Commerce Trust Company at Commerce Bank’s 2011 Investment and Economic Outlook luncheon.

The economic picture Scott Colbert painted in front of an audience of about 200 in the Reynolds Alumni Center on Feb. 9 wasn’t bleak, but it wasn’t all that rosy either.

Accelerating growth is a positive sign, he said. However, he called the current gross domestic product growth of 2.5 to 3 percent a “new normal,” rather than the 3 to 4 percent growth common during the past 40 years or so.

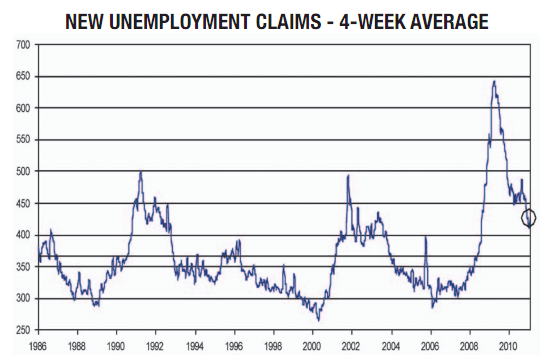

“We’re on the verge of having employment growth,” Colbert said, signaling hope that GDP growth will translate into new jobs. New unemployment claims are down, which suggests there are about 200,000 fewer workers losing their jobs each month than at the height of the recession in 2009. But the 425,000 or so new jobless claims in recent months are still around the rate of layoffs during the ’90 to ’91 and 2001 recessions.

“After going through the most anemic recovery we’ve ever had, we have made very little progress,” Colbert said.

The worry six months ago was that the expiration of the federal stimulus would “hand the ball off to the consumer,” who wasn’t yet in a financial position to continue pushing the recovery forward, he said. Household savings rates are still climbing, but retail sales showed strength last year.

“It seems a mediocre team has picked up the ball and started to run with it,” Colbert said, adding that the big question is whether the consumer-driven recovery is sustainable.

On the up side, businesses have been de-leveraging, and their reduced debt burdens should begin to free up cash for hiring. “We are going to start hiring more and more people,” Colbert said.

The economy, however, has a major structural adjustment it must still overcome. About half of the unemployed in the country have been out of a job for more than 27 weeks. Many of the long-term unemployed formerly had jobs in the housing industry, and Colbert said it will take a significant amount of time to retrain the out-of-work mortgage brokers, electricians and carpenters for an economy no longer fueled by a housing credit bubble.

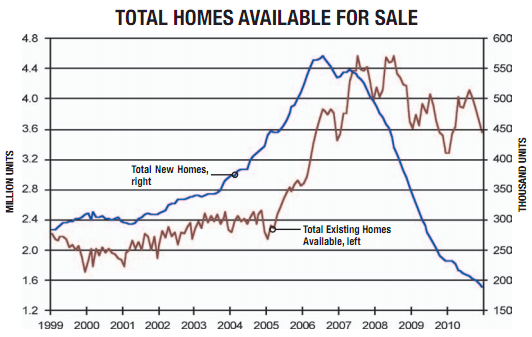

The housing market itself has not finished its adjustment. New home inventory has dropped more than 50 percent since 2008, but existing home inventory remains stubbornly high at around 3.6 million units. It will take three to five years to clear out that excess inventory, Colbert said.

“It’s still a long time, but it’s getting better,” he said of the housing absorption rate.

Delinquencies on subprime mortgages still hover around 25 percent, and even prime adjustable-rate mortgages have a delinquency rate still near 14 percent. Home prices are still falling, Colbert said, and that isn’t helping homeowners.

All that slack in the economy, from unemployment to the real estate market, means that inflation fears in the near term are overblown, Colbert said.

“The combination of those is what is keeping inflation in check,” he said.

The Consumer Price Index growth has jumped markedly since the depths of the recession (just look at gas prices). But the core CPI, which excludes volatile commodities such as energy and food, has retained a downward trend and dropped to less than 1 percent growth for most of past year.

Even so, Colbert cautioned that the easy monetary policy still underway at the Fed, including its second round of bond buying announced last year, will contribute to long-term inflationary pressures. Stimulating inflation will be much easier than “slaying the inflation dragon,” he said. Thus, he said he expects the Fed to “take away the punch bowl” late this year or early next year.

As for investment advice, Colbert suggested emphasizing domestic rather than international stocks. He also dismissed the jitters in the municipal bond market and suggested that a few outliers such as California, Illinois and New Jersey are tainting the market.

“There are tons and tons of great ‘munis’ to be had right now,” he said, pointing to the University of Missouri’s recent bond issue for campus building projects.